The Product Marketing Alliance (PMA) simplifies the GTM strategy into 5 basic elements. Each one may take significant research and team collaboration to proerly unpack. According the the PMA, on average only 31% of companies have a defined launch process. And 58% of companies budget less than $20K for launches even though 72% recognize that launches have a 'major' or 'significant' effect on revenues. The average success of launches comes in at less than 6 on a scale of 10 in their report.

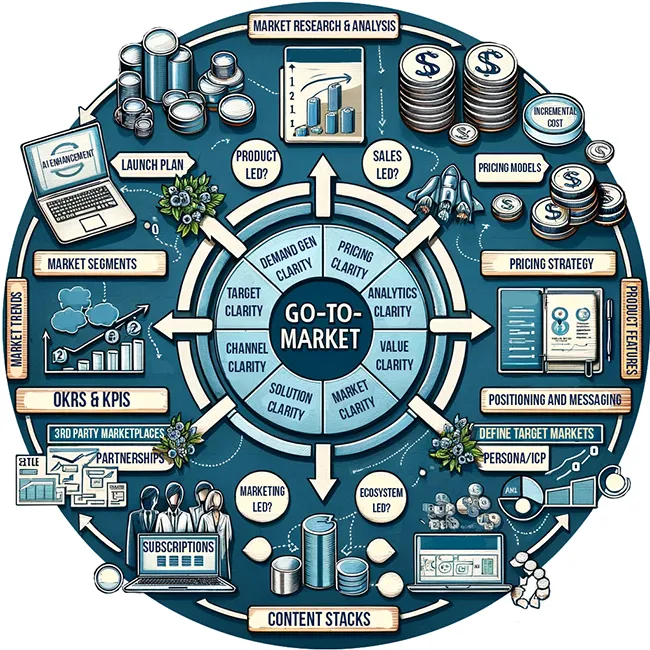

The baseline of a repeatable plan is following a set process covering the elements below. It's not magic, but it is hard work. The main challenge cited, consistently, is communication - not incorrect metrics, lack of budget, or even time constraints.

A successful GTM strategy integrates market research, customer insights, and collaboration across teams. It shouldn't be dictated solely by Product Marketing but developed through a joint effort with Product and Sales teams, ensuring authenticity.

Product Marketing sets the strategic framework, but information and insights from both product and sales shape the plan, reflecting real customer needs, product value, and market demands.

Over my career, the back of the napkin numbers suggest an average of 1-3 launches per quarter, depending on the nature of the company's product. Something the PMA report didn't ask, but should have, is how much average lead time the PMM has to launch a new product; longer is better, but I've had my share of 30 day fire drills too, where having a defined process can make all the difference.

Here are 3 interesting high-level GTM strategy examples from my work experience. Interested in the defined process itself? Just get in touch.

TERiX had a great new service offering for HP Hardware, but no one knew about it...

(click to show/hide)

(click to show/hide)

TERiX, a third party hardware services provider, had built a thriving business on offering a cheaper and equally effective alternative to Sun Microsystems support. But when Oracle purchased Sun and changed the licensing arrangement, TERiX wisely began to diversify away from Oracle to other product lines. The problem? Their existing customers who had Sun - now Oracle - didn't often have these other brands, so they would need to get into different markets from the ground floor.

TERiX had cultivated a strong partnership with HP, who had a larger and more diverse hardware footprint than Sun and who already used TERiX technicians for some of their own support work. From the partner side, TERiX was able to fill gaps and help HP deliver better service. This gave TERiX a real differentiator in the TPM space and led to co-branded outreach and close connections at events and trade shows where a significant amount of buyers congregate.

We made significant revisions to the TERiX website, which had at one time been oriented entirely around Sun Microsystems, and built multiple white papers and case study content with existing shared customers. We also initiated significant social media campaigns tied to emailed surveys targeting both HP and mixed-brand datacenters, as another pain point identified from customers was the difficulty of keeping so many hardware support contracts straight. An advantage of TPM is bringing server, storage and networking hardware from dozens of unrelated brands together on a single maintenance contract. This was strong, but not specific to TERiX, so emphasis was also placed on our close ties to HP specifically to differentiate from other TPMs.

Pricing was a point of contention but also a driver of business. HP Maintenance costs were competitive but in some markets they were already using TERiX resources for service delivery because of the cost differential. HP was concerned we would raise our prices for them as well, so negotiations helped lead to contractual committments regarding price and margin in order to drive new HP growth direct to customers without jeopardizing our strategic relationship with HP.

OKRs were oriented around measurable increases in demand and the number and quality of leads. Because website form completion and phone calls were the main vectors for intaking high-scoring leads for the new product line, it was relatively easy to assign tags and monitor increases in leads, though the specific last-touch or first-touch piece of content that pushed the lead to respond might be unknown. The main launch goal was to double HP maintenance leads from all sources from $50,000 in 2010 to $100,000 by the end of 2011. With a relatively long sales cycle based on annual maintenance expiration dates, lead nurturing was also a critical component as was wider exposure at a number of conferences and webinar engagements in the first year. By 2012, opportunities exceeded $6M and over $3M was closed in contracts. By the end of 2013 we had received over $20M in leads and $6M in closed business.

(click to show/hide)

(click to show/hide)

When your market research suggests criminals are an ideal market...

(click to show/hide)

(click to show/hide)

The 3x.com security device was a landmark product for mobile endpoint security well ahead of its time in 2010. This physical multi-RAID-packed cube of enameled white metal looked more like a next-gen gaming console, and provided an alternative to insecure Network-Attached Storage (NAS) devices as well as public and private cloud - Carbonite and a few others were only in their earliest iterations at the time. The device would generate a handshake key with any devices connected to it, and from that point on it would provide a secure, encrypted physical backup repository for all data on that device, no matter where it or the 3x Cube were physically located. Only the device with the other half of the handshake could de-encrypt the data. PCs, phones, laptops, tablets, even games and medical devices could connect once, backup forever over the internet, then go dormant for months or years.

The initial target, as a replacement for traditional datacenter backup hardware, quickly proved to be a poor fit for this device (though a blade form factor mountable in a standard rack was developed to reach this market, who didn't care about the backup device being mobile, less than 2 years later). The advantages of mobility and hands-free operation were convenient but not in demand in that market. We dove deep into research from there, identifying a latent need in the healthcare space where mobility and usability by otherwise non-technical practicioners was a higher value. But we also realized that the device as-is would be a perfect solution for anyone trying to hide their activities from the law, so each sale was closely monitored and in those discussions we uncovered a latent and significant need for exactly this kind of device within law enforcement and government operations, particularly field operations.

Turning the messaging and content away from its original enterprise datacenter targeting into government-facing media was a complex process, accomplished in stages and with a strong nontraditional/Native content element because more traditional publications and digital didn't reach this new market. Instead, the company took on an endpoint security thought leadership position, with articles on laptop backups and best practices published in Government Security News and similar media, and attended government agency conferences rather than private sector events with the limited available budget. Our first customers were delighted and provided valuable case study content to drive additional adoption, and a number of natural disasters helped prove the value of the product, with 2011 being the third most active hurricane season since records began in 1851. An Outer Banks datacenter flooded by hurricane Irena was restored quickly from a safe backup at an inland location, and in another case, a small private business that had been hit with a ransomware attack was able to back up everything from the 3x device and come back to normal operations in hours rather than months.

A cost-plus model was used initially because it was very easy to add up the raw materials and time/overhead involved in building each box, but very quickly we found that a subscription model posed a much lower barrier for our customer base and helped us compete with cloud-based competition more effectively. The pricing innovation was to use the pattern established by wireless phone companies like T-Mobile and Verizon, where the hardware could be purchased outright at a premium or rolled into the service subscription. Accomodating this change necessitated some design changes - in its original form, once purchased the device was not monitored in any ongoing way by 3x. In later iterations a service code allowed direct customer access to premium 1-hour support and additional fast-restore and restore-anywhere features which would be disabled if a subscription was cancelled.

3x Systems was a classic example of product-led sales, and units sold was an easy scoring mechanism; the time between first touch and sale was also closely monitored. Adoption was also a KPI for incremental releases after the Mark I. In both cases, initial wins largely became advocates who added credibility to top of the funnel content. Though aggressive goals were set not only for launch successes but for the sale of the company itself as a metric, the results exceeded expectations, especially in targeted state and local government markets. This rapid growth in private and public sectors led to several awards for the startup including CEO of the Year from TechColumbus, which added to press interest and market awareness of our news releases. Solid growth surrounding the core product enabled the ownership to retarget the original market they had intended to go after by changing to a mounted rack form factor rather than mobile cube, incorporating the same secure encryption technology and multi-RAID secure failover architecture.

3x Systems was acquired by Trustyd in October of 2012, exceeding the 2013-2014 exit goal of the company's investors.

(click to show/hide)

(click to show/hide)

From 3 local customers to the largest independent national payroll data provider...

(click to show/hide)

(click to show/hide)

Clicking the 'import my W-2 data' button on tax preparer websites is a big time saver and error-reducer for employees at tax time, and a lucrative marketing channel for the tax preparer companies. An entire industry exists behind that process, involving payroll companies, data privacy and per-download compensation. PaydayPERX customers for digital employee benefits are using either their own or a partner payroll company, rather than large companies like ADP and PayChex, so they normally couldn't offer this auto-import feature - until one of our customers who offered it on a small scale decided it wouldn't be too hard to scale it up. It was outside of our normal service profile, but we thought it might be viable.

PaydayPERX already had the precious element of trust from HR and payroll customers who used PaydayPERX as an extension of their own team, and provided our benefits and offers to their employees; clearly we could not have successfully asked strangers to allow us to host a copy of their payroll data to provide this service. Initially we had wanted to compensate the employers, and for staffing and other employers with only a loose connection to their employees, that strategy was effective.

For others we discovered that the benefit to employees and its reflected benefit on their employer overcame any objection, which was generally about complexity rather than privacy as we already handled W-2s for most of these customers. Most employers wanted to give their employees the fortune-500 experience of using auto-import features, and employees wanted to get their tax refunds up to 2 weeks early, another benefit of using auto-fill. Those companies just got confused by compensation, so we changed the tactics and the messaging to meet hat they did expect.

This program involved the customers, tax preparers who would be purchasing the individual downloads, but it depended on the distribution channel - for employers to allow us to use the data, and for employees to actually go to one of these tax preparers and use the service. Tax Preparers were used to working with large-scale payroll and financial services companies, not independent providers of the data and not marketing services companies like PaydayPERX, so we began with test cases and technical demos for the tax preparers, primarly H&R Block in year 1. On the distribution side, approval would be through HR Executives or payroll managers who were interested in outcomes rather than the details of process, with messaging and outreach - primarily email sales sheets with web content support - oriented around employee demand and ease of adoption. We identified 3 top distribution candidates and built intitial programs and messaging around them.

Financial records of this kind have a stable market value, and the market for them is relatively mature through the banking and credit industry. Rather than setting a product price, we negotiated the per-download rate with each of the tax preparers based on those market standards. Our infrastructure costs were lower than other providers who also hosted and stored this data year-round, allowing us to make a better margin at the same price by focusing only on tax time and then securely erasing our records after the season ended. For staffing companies and data aggregators, we provided a strong commission structure but were always at 30% or better margin.

Tax Preparers paid PaydayPERX based on usage, and usage was tied to the number of payroll records onboarded into the program as well as our ability to promote the program to employees, who would use the service for free but needed awareness of this new benefit. We tracked the number of EINs and records which told us how many individual companies and employees participated, and provided employers with marketing content to drive up awareness and usage. In its first year the program launched at small scale with only 3 employers and was a moderate success, as well as an important testing ground to refine the features and messaging of the product. In years 2 and 3 it was highly profitable, and we found a solution to a common objection from large employers regarding uploading data in any way felt like a risk; this led to the development of a connector technology that let them simply make a local copy where we could route the requests. In 2022 PaydayPERX managed a pool of over 11 million payroll records and the program will continue to grow.

(click to show/hide)

(click to show/hide)

Samples: Market Briefs for Accela Civic Platform (SaaS), Hyland OnBase (ECM) and Digital Transformation Services at 3SG Plus.

Site built by Monica Bower.

Contents, samples and collateral © 2012-2025 Monica Bower and/or their respective owners and used with permission. Images created by Monica Bower. Images are free to use under CC-SA-BY. Find out more about the site on About Me.

Candy, Popcorn and Space Adventures - meet my toplevel domain on Galaxy Sweet